The US and China have an opportunity to unite and fight this pandemic, but alas!

Literature shows that since 1949, the US– China relations have evolved from tense standoffs to complex mix of intensifying diplomacy, growing international rivalry and increasingly intertwined economies (Council on Foreign Relations, 2018).

the backdrop of the US-China feud, here, we look at the trade relations between US and China and highlight a possible deterrent tool in the form of a monetary penalty as a recommendation against tariff retaliation.

Traditionally, such countercyclical, protectionist trends have had a significant negative effect on the volume of world trade. The most significant example of this was when the world economy experienced a huge shift towards protectionism, implementation of the 1930 Smoot-Hawley Tariff in the US, which was ideally a law that implemented protectionist trade policies in the US.

Tariffs are usually used as a shield to protect domestic industries from foreign competition. So, when the farmers in the US were struggling financially in the late 1920s, Senator Reed Smoot and Representative Willis C. Hawley sponsored a tariff bill that was originally meant to raise tariff for agricultural products specifically to help American farmers. This is known as The Tariff Act of 1930 or Smoot-Hawley Tariff in economics. Imposition of tariff would increase the cost of foreign goods making American goods relatively cheaper and therefore more attractive to customers. However, eventually tariffs were imposed on a huge variety of items and not just on agricultural products.

Soon after the imposition of tariffs, the international outrage was swift. Some counties struck back with higher tariffs on American goods making them more expensive and competitive in the foreign markets. So, as US resorted to protectionism, US exports fell just as much as its imports and this most certainly did not help US farmers as most of them used to sell their crops overseas.

The process of tariff retaliation between countries had a global impact and eventually led to a decline in international trade system and perhaps deepened the Great Depression, which was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the US.

Today, almost all countries are connected by trade supporting jobs and businesses around the world. So, the dangers posed by the trade war now have a greater potential for political destabilization and economic hardship on a global scale.

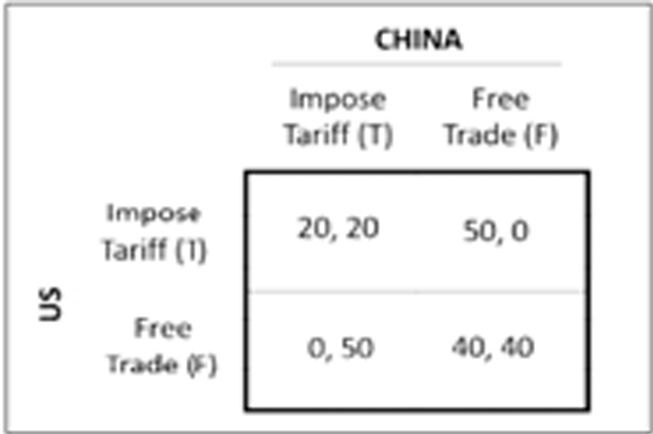

Thus, to ensure maximum benefits from trade, global institutions can impose financial penalty on countries engaged in tariff retaliation. Such a form of disincentive is formulated using the payoff matrix:

Strategic trade theory describes the decision making of governments when trying to influence the outcome of an economic interaction between themselves and another nation.

Here we apply the Prisoners Dilemma Game. We assume there are two players, the US and China. The players have two strategies each at their disposal – impose tariffs (T) or maintain free trade (F). Using arbitrary numbers their preferences are defined as US: TF>FF>TT>FT; China: FT>FF>TT>TF

In game theory, Nash equilibrium, proposed by John Forbes Nash, is a solution concept of a game involving two or more players, in which each player is assumed to know the equilibrium strategies of the other players, and no player has anything to gain by changing only his own strategy unilaterally. So, ideally it determines the optimal solution in a non-cooperative game in which each player lacks any incentive to change his initial strategy.

Here, in our analysis, the best response for each player is to impose tariffs which result in the Nash Equilibrium from which neither player has an incentive to deviate. Even though this is the optimal response both countries could have received higher payoffs if they had coordinated. This ‘coordination’ is both encouraged and policed by the WTO.

If both, the US and China maintained free trade, then both countries would have benefitted from higher levels of trade and received higher payoffs.

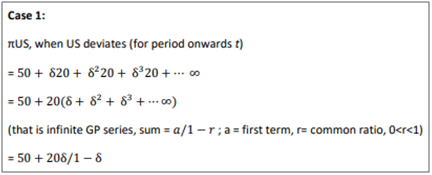

Now to derive the penalty for deviation from free trade, we use the concept of the Trigger Strategy Nash Equilibrium. It the theoretical notion which can be used to explain the long-term implication of the deviation from agreement by one party and in turn consider its potential linkage with the strategy attained by each party in every period. In the event of a one-time deviation by one of the interested parties, it may be expected that there will be retaliation by the opposite party in the next successive period.

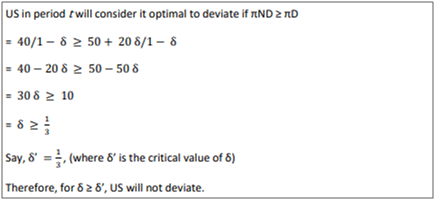

Hence, we can assume that if US deviates, China will deviate in the next successive period. As a result, there will be a rise the question of optimality in rigor to the deviation.

To explain this, here, we have introduced a discount factor denoted by ẟ. This factor discounts the payoffs (here, in USD) arising in the period post deviations. Trigger strategy envisages the non-deviating ‘player’ to deviate every time subsequent to period t when the deviation occurs for the first time.

To evaluate the position of interested parties, using the above Nash equilibrium, let us look at the payoffs (π) for the US (referred to below as πUS), in specific conditions:

- If US deviates, then in period the US receives a payoff (π) of 50. Further when China does the same in the following period, they will receive a payoff of 20. This continues in a countercyclical progression (50,20,20…).

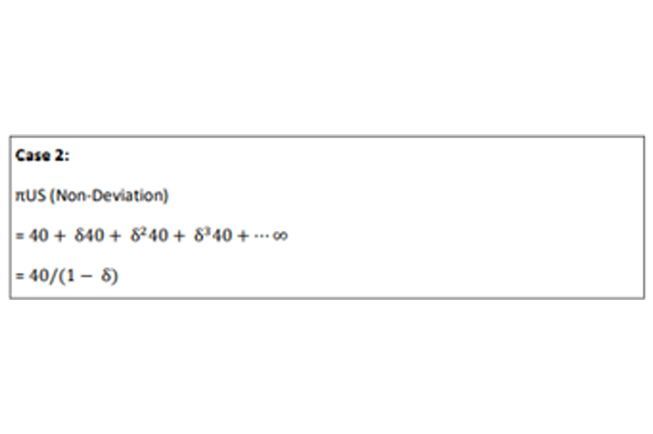

- If US does not deviate, then the payoff remains 40 constantly (40, 40, …)

Based on these assumptions, we can consider two cases as outlined below:

Proposition: ẟ can be considered as the penalty rate for every deviation there will be imposed 1/3 cents of penalty. Thus ẟ’ can be the optimal level of penalty that an international organization can impose on the countries engaged in tariff retaliation, thereby ensuring maximum benefits for global trade.

Reflecting on the current status we can say two years after the US imposed the first trade war tariffs, its trade deficit with China has narrowed, but wider relationship are being held together by the sticking plaster of a phase one deal. However, now the global health crisis seems to evidently hurting the fragile truce between Beijing and Washington.